📈 Controlling Inflation: Around the Globe

The RBI alone cannot control inflation. The government needs to step in as well. And here's what the Indian government can do to make lives easier for us.

Dear readers, we know we have been talking about the inflation demon for literally months now, but we have no choice but to keep resuming this discussion, because the demon keeps resurfacing.

India has already spent over $100 billion in boosting the rupee against the dollar so that we don’t have to spend extra money on imports (something that majorly fuels our inflation; you can read more about this here).

However, this has also not helped cool down inflation.

And according to the IMF, this isn’t an option anymore.

So, what can India do to fight inflation? Keep raising interest rates?

Well, we may have a few other unexplored options. ReadOn!

🤔 First, What is the IMF's Latest Advice?

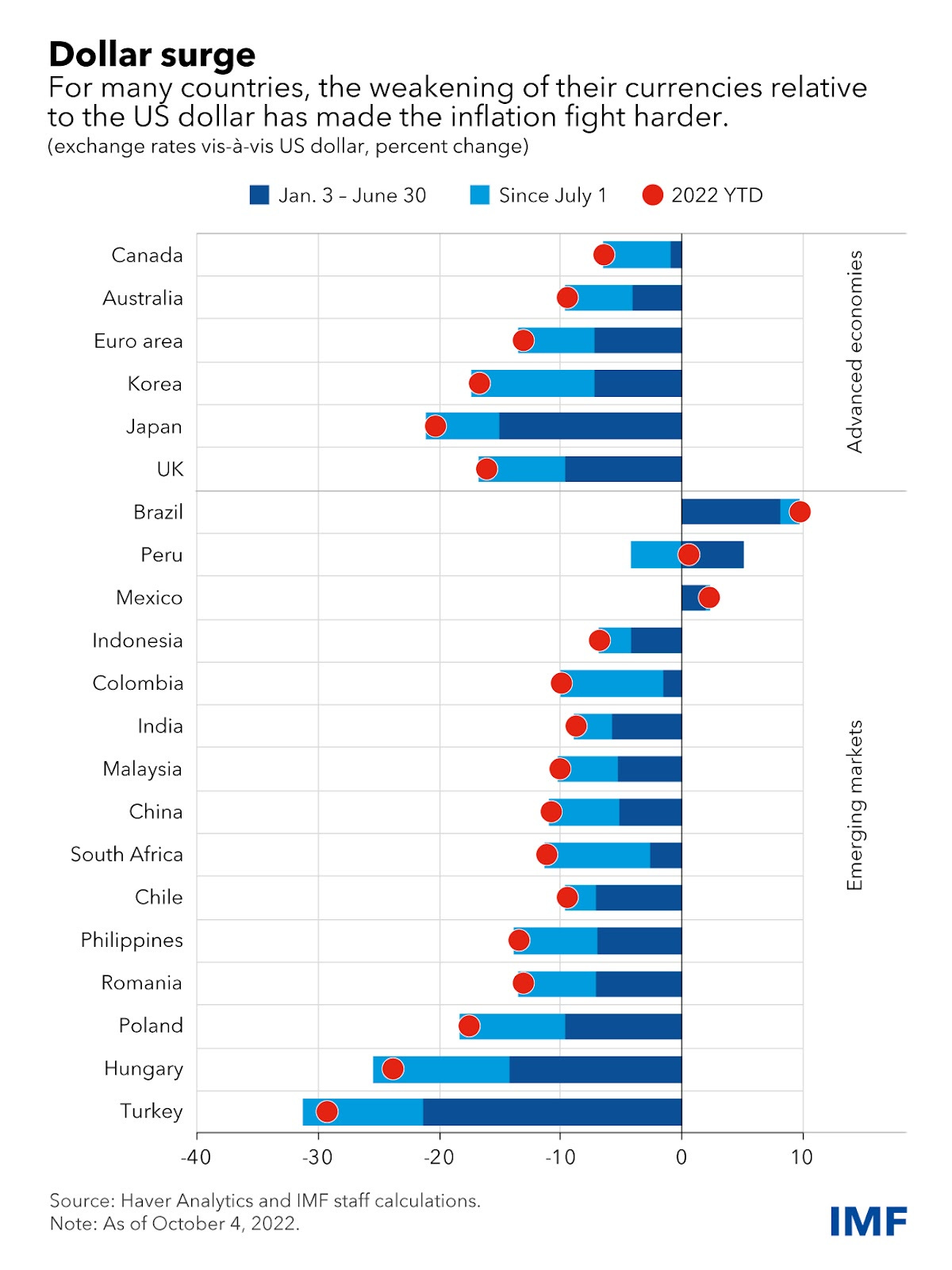

The dollar is at its highest level since 2000. So, most countries are seeing their currencies decline.

And, like India, these currencies are selling their dollar reserves in the market, to bring down dollar’s price and raise their currency’s value.

But IMF wants them to stop this. Why?

This is what the IMF’s economists have to say:

The appropriate policy response to depreciation pressures requires a focus on the drivers of the exchange rate change and on signs of market disruptions. Specifically, foreign exchange intervention should not substitute for warranted adjustment to macroeconomic policies. There is a role for intervening on a temporary basis when currency movements substantially raise financial stability risks and/or significantly disrupt the central bank’s ability to maintain price stability.

Source: https://www.imf.org/en/Blogs/Articles/2022/10/14/how-countries-should-respond-to-the-strong-dollar

Jargon free interpretation: Don’t spend all your dollar reserves now, because the worst is yet to come. Instead focus on macroeconomic policies (policies that concern the entire economy).

What policies should India focus on?

Well, for starters we will have to keep increasing interest rates as long as the US keeps doing so to prevent further depreciation of the rupee.

But monetary policy (policies taken by the RBI specifically) alone cannot get us out of this inflation. It can just help us boost the rupee, which is great but not enough.

We have already increased interest rates by 190 (1.9%) basis points in the last six months but have not been able to control inflation.

So, fiscal policy needs to come into the picture.

Fiscal policy is the government’s way of using taxes, increasing revenue or decreasing expenses to control the economy.

🧐 What Fiscal Policies can India Implement?

India could begin with raising some taxes, which would increase its revenue and reduce our current account deficit (you can read all about it here).

Plus, this will suck in money from the economy, leaving people with less spending money.

Now, we know this sounds like a bad thing but this will reduce demand in the market. Which means, less money will be chasing more goods, reducing their prices (you can read more about inflation here to understand this better).

But this could also impact India’s growth. And that could throw us into a recession.

So, option number two is that the government should decrease some of its expenses and use this money to put price caps on goods and introduce subsidies.

This will help our economy to keep growing but it will also not bring down demand and is at best a temporary solution. But even this temporary solution could help pull out a lot of people from imminent poverty.

If our government can manage to sustain this until the Russia-Ukraine war is over and the usual supply of goods is restored, then we could beat inflation while we continue to grow: a major win for us.

Here’s a look at what other countries are doing to beat inflation:

France: France has introduced a $20.3 billion inflation relief package, which has increased people’s pensions and welfare payments. Plus, it has allowed companies to give employees higher tax-free bonus payments to increase their purchasing power.

Spain: Spain introduced a windfall tax on banks and energy companies (both of whom are making more money due to the rising inflation and interest rates). It is using this money to make public transport free, build homes and provide scholarships.

United States: The US has also passed an inflation reduction act worth $430 billion which has reduced the cost of medicines and increased corporate taxes.

Poland: Poland has introduced payment holidays which allow citizens to skip mortgage payments for 8 months.

But our government is already facing a massive current account deficit. Do you think we can afford to implement such measures?

⚡In a line: The government and the RBI together need to take control of inflation but this could increase the government's expenditure significantly.

💡Quick question: Which of these measures do you think India should apply?

Share this with your friends via WhatsApp or Twitter and help us grow! See you tomorrow :)

You can also listen to our stories. Catch it on Spotify, Apple Podcast, Amazon Music, Google Podcasts, Gaana or Jio Saavn.

If you are coming here for the very first time: Don’t forget to join us on WhatsApp to get daily updates! 👇

Awareness is key for understanding that INFLATION MAY HAPPEN DUE TO GLOBAL FACTORS TOO.....