🤯 Banks Can Now Sell Fraud Loans?

Government is all set to give fraudsters a tough time. Here's how the lending business is about to change.

News Flash: Banks can now sell fraud loans to Asset Reconstruction Companies!

Fraud loans? Asset Reconstruction Companies? How does it matter? Let’s find out!

Let’s say a bank gives a car loan of Rs.10 lakhs to you. This particular amount is an asset for the bank (it can recover the money from you) and a liability for you (you owe them the money).

Banks expect to recover these loans from time to time.

But, obviously, you can’t expect full recovery (unless you lend only to Harishchandra’s of the world).

So, are you saying that banks know in advance that some people would pull a Vijay Mallya?

Yes.

They know some money won’t come back - they don’t know who will not payback.

So, these loans, when not timely paid, turn into NPAs (Non-Performing Assets). And, some of these NPAs involve a criminal element such as siphoning or stealing of the loan amount by someone in the borrowing entity. These NPAs are called fraud loans.

Between 1998 and 2002, the NPAs in India rose upto 10% to 14%. Losses were mounting for the banks and something had to be done.

To take away the pain of these bankers, Asset Reconstruction Companies (ARCs) were formed.

The non-performing “assets” of a bank are still assets - which they sell to ARCs at a low price and save time, effort and money wasted on catching hold of the Mallya’s of the world.

Plus, vasooli is not the core job of a bank, is it?

If the recovery amount of ARCs is higher than what they paid for the loan, they make money. Also, there are some businesses that need just a touch of expertise and professional problem solving to revive.

ARCs try to make the fallen warriors stand back on their feet.

But, are ARCs even profitable?

Believe it or not, they are. They have maintained around 7% Return on Equity (ROE) since 2016.

Now, this system has certain hiccups. For instance, NPAs that were classified as 'fraud loans' were not allowed to be sold to the ARCs.

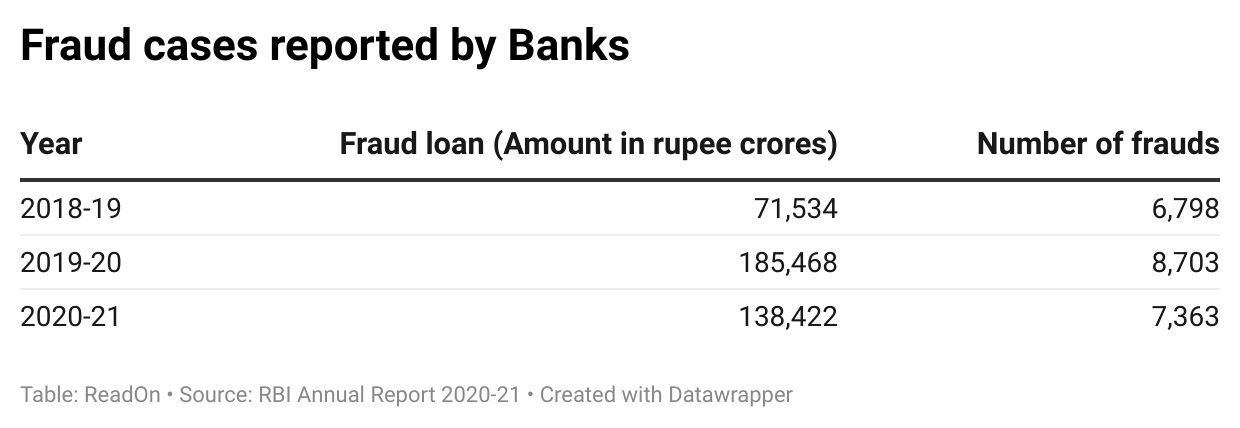

But the fraud loans are on rise, and it is all the more difficult to make recoveries in such cases. Shouldn’t the banks be allowed to hand it over to experts, if there were to be any shot at recovery? And so banks have now been allowed to sell their loans to ARCs.

Doesn’t this move mean that banks can just keep lending money with no worries in the world? Later on they can simply put the topi (cap) on ARCs head?

No. Passing off loans does not absolve banks from accountability. They will still have to follow protocols and will be answerable for the bad loans.

ARCs could also buy such loans at bigger discounts. But it’s a risky bet. Even though RBI has paved way for allowing the sales of fraud loans, will ARCs bite the bullet?

This is where the National Asset Reconstruction Company (NARC) comes into the picture.

In other countries where a structure like ARC has been successfully introduced, these structures are mostly set up with either direct equity participation or support from the government. But Indian ARCs are private sector entities.

This has had some problems. Banks sell their loans to ARCs. But the ARCs get a large chunk of their funds in the form of loans and capital from these banks themselves. This circular movement of money makes ARCs just another extension of banks, right? Isn’t the whole purpose defeated then?

Also, ARCs have capital constraints. There are 28 ARCs at present and they have been helpful for the resolution of loans of small values. But to soak in the large NPA accounts piling up lately, an ARC with deep pockets was required. Keeping this in mind, NARC was incorporated in July 2021.

The Central Government has given NARC a guarantee of Rs. 30,600 crores and Public Sector Banks have 51% ownership in the entity.

Now the only problem that remained, was, ARCs did not have permission to acquire fraud loans. But the government wanted the fraud loans to be resolved. So to give NARC the permission to acquire fraud loans, the whole law has been changed.

Do you have faith that the recovery of fraud loans will improve with this move?

Only time will tell...

Share this with your friends on WhatsApp and Twitter!

If you are coming here for the very first time: Don’t forget to join us on WhatsApp to get daily updates! 👇